1. Finance has outgrown national governance; banking reform beyond deposit-taking must be multi-national to be effective. For European countries the EU's "normative power" provides an available and important space to do this.

2. Remember competition policy. We have to manage economic entities so that:

- their failure doesn't threaten the whole system (that means smaller banks, whether split between investment and retail or not)

- their power doesn't create imbalances in our political system (i.e. threaten government's capacity to make decisions in the interests of the whole). Overly dominant institutions use lobbying, funding and PR to drive policy in their interests (e.g. oil companies in the US)

3. The last three years has seen the extent to which banks operate with the implicit backing of governments. We need to make more explicit the conditions of licences to operate. Review, publicise and retool.

4. Introduce a better risk reporting matrix for pension funds. In the light of the huge impact of systemic volatility on pension finds over the past three years, pension funds need to better understand that fiduciary duty means addressing systemic as well as stock risks. Governments need to make explicit their requirement that funds do this (as distinct from telling them how to do this). Requiring reporting on a matrix of risk areas would force them to analyse and exposes long-term issues.

5. The achieve a rapid shift an economy governments need to use Government preferencing tools to better align political policy with financial priorities

- tax credits

- guarantees

- on-lend to local banks (i.e. use their distribution) for targeted programmes (e.g. green businesses)

- regulatory support (e.g. outlaw high-carbon investments)

That applies most urgently to green economy transitions.

6. Improve consumer protection. In the UK for example consumer protections have lagged behind other countries. This has the benefit of limiting opportunities to un-sustainably gouge consumers (it protects financial institutions from their worst tendencies).

The most urgent in the UK is to cap usurious interest rates. Many countries have a cap; Australia has around 50% for example. "Wonga.com", with interest rates in the thousands, should not be allowed in any market.

Equally, mortgage market regulation should mandate maximum lending ratios, capping them at 80% or 90%. This mitigates against practices dependent on upward market valuations.

7. The most important thing we could to encourage more productive capital allocation in anglo countries would be to tax income spent on mortgage payments just as we tax income spent on rent. It would reduce speculative pressure, even up the financial equivalence of renting and home-buying and push capital to other investment options where it's more urgently needed, such as the transition to a green economy.

Sean Kidney's Blog

Financing the transition to a low-carbon economy

Friday 27 May 2011

Tuesday 19 April 2011

Friday 15 April 2011

Wednesday 2 February 2011

Dubai mandates roof gardens for all new buildings = thermal insulation,greener environment

Great idea that will help cool the city down, among other things. Five stars!

Monday 24 January 2011

Friday 7 January 2011

Friday 24 December 2010

Useful "reducing solar cost-curve" story from the Economist

The renewable-energy business - "Shining a light"

The Economist 11 Dec 2010.

THE future, according to MiaSolé, a Californian start-up, is unrolling at one centimetre a second in a bland-looking building in Silicon Valley. Despite the location, and the fact that most other solar cells are made from silicon, MiaSolé's cells are not. Ribbons of steel a metre wide and half a hair's width thick spool through vacuum chambers in which they are sputtered with copper, indium, gallium and selenium—collectively known as CIGS. Out of the end comes a new type of solar cell which promises to be both efficient and cheap.

MiaSolé's current cells turn 10.5% of the light that hits them into electricity. A tweaked version that manages 13% should go into production early next year. Further tweaks have produced cells with an efficiency of 15.7%. This is as good as the best silicon cells and much better than those of First Solar, an American company which uses another cheap technology and is the biggest maker of solar cells in the world. MiaSolé says its manufacturing costs work out at less than $1 per watt of generating capacity. This is better than all silicon-cell-makers and far less than the $3 per watt of Solyndra, a rival CIGS firm that won a large loan guarantee from the American government to build a big factory.

All to the good: the rationale for the industry's generous subsidies has been that as volumes increase and manufacturers get more experienced, costs will decline. For much of the 2000s, with a shortage of pure silicon and lavish support from European governments, the price of solar panels failed to fall as expected. But since January 2009, according to pvXchange, an online marketplace, the wholesale price of solar modules in Europe has dropped by 43%. This is bad news for high-cost producers. And cheap, efficient thin-film cells like MiaSolé's will make life harder still. So will a slackening in the growth of demand for solar panels: this year it doubled but demand is likely to grow by just 10% or so in each of the next two years.

However, electricity consumers' anger at their big bills is now forcing Germany to cut its subsidies. By January they will be a quarter lower than in early 2010. Politicians elsewhere have watched and learned. On December 2nd France's prime minister, François Fillon, suspended all non-household applications for his country's feed-in tariff scheme. In Italy, Europe's second-biggest market, fat tariffs will be trimmed in stages next year. Even so, Italy's combination of sunny skies and high retail electricity prices mean that demand for solar power is likely to keep growing.The solar-cell boom has been a mostly European phenomenon. Spain, then Germany, boosted demand by giving generous "feed-in tariffs" (subsidies) to anyone who produced solar power for the grid. Spain's subsidies were slashed after 2008. Germany's generosity has lasted longer. As a result of this, and falling prices for solar cells, demand for solar power doubled to 7,400MW in the past year, reckons GTM Research, a consultancy. Solar power now produces up to a tenth of Germany's electricity on sunny days.

Most of the growth in demand will be elsewhere, however. China will become a big user, as well as maker and exporter, of solar cells. America is likely to build lots of large-scale solar plants. Shayle Kann of GTM Research calculates that the power-purchase agreements signed by America's utilities will expand its solar capacity from 214MW now to 5,400MW by 2014.

American utilities are signing up for renewable energy mainly because their regulators insist on it. But solar's improving economics are making this imposition less onerous. Travis Bradford of the Booth School of Business at the University of Chicago says that taking into account all the costs of construction including its finance, a state-of-the-art solar plant in a sunny state is broadly competitive, over its life, with a new "peaker" gas-fired station. Gas peakers, turned on only when demand is at its highest, are the most expensive fossil-fuel plants. Even so, getting to this level of competitiveness is a big step forward for solar.

The low risk and highly predictable returns of solar installations are also attracting new investors. At the end of November SunPower, which makes particularly efficient solar cells, announced that a subsidiary of NRG Energy, a New Jersey power company, would finance a 250MW Californian project that SunPower had been working on for a few years, a vast deal by the standards of the industry.

This all adds up to a bright future for cheap solar energy. The lowest-cost producers should soon be able to compete without subsidy against high-priced competition and in very sunny places. As solar cells' manufacturing costs keep falling, there will be ever more places where they are as economical as fossil fuels, without any need for green justification.

Saturday 11 December 2010

Sunday 5 December 2010

7 Cancun snippets: >machine-guns >Japanese pre-emptive strike >climate talks head in tears >and more

Friends: I'm at the COP16 Conference in Cancun, aiming to talk about climate bonds as a mechanism to divert private investment to building a low-carbon economy. Here are six snippets from my first 24 hours:

1. Cancun's surrounds have that beautiful blue you get in tropical waters, and endless green forest. It also has, as you drive out of the airport, machine gun-armed soldiers lining the street and manning roadblocks on the freeway. A bit chilling; a shadow of the conflicts to come if we get catastrophic climate change. Attending the Conference requires endless bus shuttling between a (well-organised) set of big sheds out in the bush and huge hotel complexes dotted along the coast; the government negotiators are holed up in a vast resort called Moon Palace. Crowds are much smaller than at Copenhagen - lower expectations this time.

2. First big announcement: Japan refuses to extend Kyoto Protocol. Full stop. Kills stone dead the push by G77 countries, including China, to extend the current agreement for another “commitment” period of developed countries paying the developing. Japan says the only agreement it will sign is one that includes binding reductions by China and India, among others. The move apparently came out of the blue for other delegations. China and Brazil are not happy.

3. Then the World Meteorological Society announces that 2010 was, so far, one of the three warmest on record – and the current cold snap in Europe doesn't change that (part of the increased weather volatility climate change brings). BTW, the three warmest years on record have all occurred since 1996.

4. China this week got a €500 mil loan from the European Investment Bank to invest in renewable energy. Good stuff - but such a pity the Bank also just lent €550 mil for coal-fired power in Slovenia. How do we get the right hand working in concert with the left hand?

5. The head of the UN climate talks body apparently fought back tears in a meeting with youth activists on Wednesday. After talking about the lack of ambition among global leaders for an agreement among economic and political constraints, she was asked what keeps her going. She choked up as she answered “the next generation”.

6. Meanwhile the negotiators labour their way through the various texts of draft agreements, with interminably polite arguments about [bracketed] text - the sections they haven't yet agreed on. For example there was a lot of to and froing today as G77 countries pushed to have the word "increase" taken out of brackets in a clause about funding "capacity-building". In another EU seminar on climate finance a speaker was explaining that developed world debt would be up 120% this year, while developing world debt would go down 40%. It may be seen as unjust by the G77, but there seems little chance of having that work "increase" taken out fo brackets.

7. The Koreans on the other hand are staying optimistic. Last year they spent more of their economic stimulus budget on green investments than anyone else. At a Korean Global Green Growth Institute seminar today their former Prime Minister explains how they're working with a number of developing countries on investing to create a low-carbon economy that delivers greater prosperity. Nick Stern chaired the session, touting Korea as the case example of how to do it right. Perhaps they can advise recalcitrant countries like Australia and Canada as well?

Cheers,

Sean Kidney

This is the first of an occasional update during COP16.

> Please pass on as you see fit.

Monday 22 November 2010

Thursday 4 November 2010

New York Times story on Climate Bonds

Note comments by Sean Kidney.

First time the International Herald Tribune and the New York Times have covered the issue in this fashion. Story begins:

"SINGAPORE — Financial experts may debate how much it would cost to shift the world to a low carbon economy, but they agree on one thing: the amount would be phenomenal. The International Energy Agency in Paris, for example, has estimated that it would take $46 trillion in additional clean-technology investments over the next 40 years to halve carbon emissions by 2050.

Today, funds mobilized to address climate change are primarily coming from the private sector. While there is also some public investment, there remains a clear gap between what is needed to deal with climate change and what is available. How to close that gap has become a subject of intense debate."

Also mentions the Climate Bonds Initiative:

"Sean Kidney, chairman and co-founder of the Climate Bonds Initiative — an international network that advocates raising money through the bond market for climate protection projects — argues that “themed” bonds have long been a way to raise large sums of money for specific purposes."

First time the International Herald Tribune and the New York Times have covered the issue in this fashion. Story begins:

"SINGAPORE — Financial experts may debate how much it would cost to shift the world to a low carbon economy, but they agree on one thing: the amount would be phenomenal. The International Energy Agency in Paris, for example, has estimated that it would take $46 trillion in additional clean-technology investments over the next 40 years to halve carbon emissions by 2050.

Today, funds mobilized to address climate change are primarily coming from the private sector. While there is also some public investment, there remains a clear gap between what is needed to deal with climate change and what is available. How to close that gap has become a subject of intense debate."

Also mentions the Climate Bonds Initiative:

"Sean Kidney, chairman and co-founder of the Climate Bonds Initiative — an international network that advocates raising money through the bond market for climate protection projects — argues that “themed” bonds have long been a way to raise large sums of money for specific purposes."

Monday 1 November 2010

About forests and trees and pension fund myopia

Fiduciary duty for a pension trustee is about protecting the financial interests of fund members in the long term. Or, in the language of the pensions world, “maximizing risk-adjusted returns over the long term, consistent with the interests of participants”. Why then do pension funds spend more time looking at the trees rather than at the forest? > Read More

Friday 15 October 2010

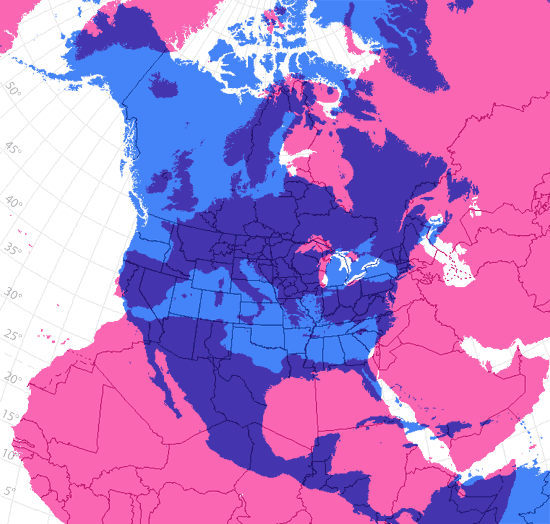

Cool map of Africa vs other countries, plus a few others

Information Is Beautiful |

The True Size Of Africa Posted: 14 Oct 2010 10:08 AM PDT  Brilliant infographic from Kai Krause (perhaps the Kai Krause?) to combat rampant 'immappancy' (Now corrected for map projection errors by marauding carto-nerds – thanks Manuela Schmidt) I would perhaps twin it with these:    (Credits: USA – unknown, Antartica – NASA, Australia – unknown) |

Thursday 7 October 2010

Act now or face trillions in climate asset losses, UNPRI-backed report tells long-term investors

New UNEP Finance Initiative report says long-term institutional investors could see trillions wiped off their assets unless they force companies, regulators and asset managers to reduce the impact of climate change.

Useful reminder of the real systemic risk pension funds need to be looking at.

Wednesday 6 October 2010

Great little climate chart

Tired of obscure tables of temperature anomalies and confusing maps of summer sea ice volumes?

Here's a simple chart that ordinary Americans can relate to - the proportion of record highs to record lows at individual US weather stations since the 1950s.

2009 National Center for Atmospheric Research study of 1,800 weather stations in the 48 contiguous United States over the past six decades (see Record high temperatures far outpace record lows across U.S.

Here's a simple chart that ordinary Americans can relate to - the proportion of record highs to record lows at individual US weather stations since the 1950s.

2009 National Center for Atmospheric Research study of 1,800 weather stations in the 48 contiguous United States over the past six decades (see Record high temperatures far outpace record lows across U.S.

Subscribe to:

Posts (Atom)